What is an IPP?

An Individual Pension Plan (IPP) is a defined benefit pension plan designed for incorporated business owners and professionals. It allows for higher tax-deferred retirement savings compared to an RRSP.

Who can setup an IPP?

An IPP is ideal for individuals who:

- Own a corporation or are incorporated professionals

- Are over the age of 40

- Have an annual T4 income exceeding $100,000

- Seek a tax-efficient retirement strategy

Benefits of an IPP for small business owners and employees

- Tax Deductions: Contributions made by the corporation to the IPP are tax-deductible, reducing the company’s taxable income.

- Capital Gains Tax Reduction: IPPs reduce the business’s taxable value, lowering capital gains tax when selling the business.

- Transfer to Spouse at Death: Upon the owner’s death, assets within the IPP can be transferred to a spouse’s pension or RRSP, ensuring tax efficiency.

- Lump-Sum Contribution at Plan Setup: Business owners can make a large past service contribution when starting the IPP, reducing taxable income.

- Lump-Sum Contribution Before Selling the Business: Additional contributions (terminal funding) can maximize pension benefits and lower corporate taxable income.

- Creditor Protection: IPP assets are safeguarded from creditors, unlike RRSPs in some provinces.

FAQs about IPP

- How does an IPP differ from an RRSP?

An IPP provides a guaranteed retirement income, whereas an RRSP depends on investment performance. - Can family members be included?

Yes! If they are employed by the corporation and receive T4 income, they can participate. - What happens to the IPP upon retirement or death?

Retired members receive lifetime pension income.

Upon death, benefits can transfer to a spouse’s pension or RRSP. - Can I still contribute to an RRSP if I have an IPP?

RRSP contribution room is reduced due to pension adjustments. - Are there administrative requirements?

Yes. IPPs require actuarial reviews, corporate filings, and ongoing plan management.

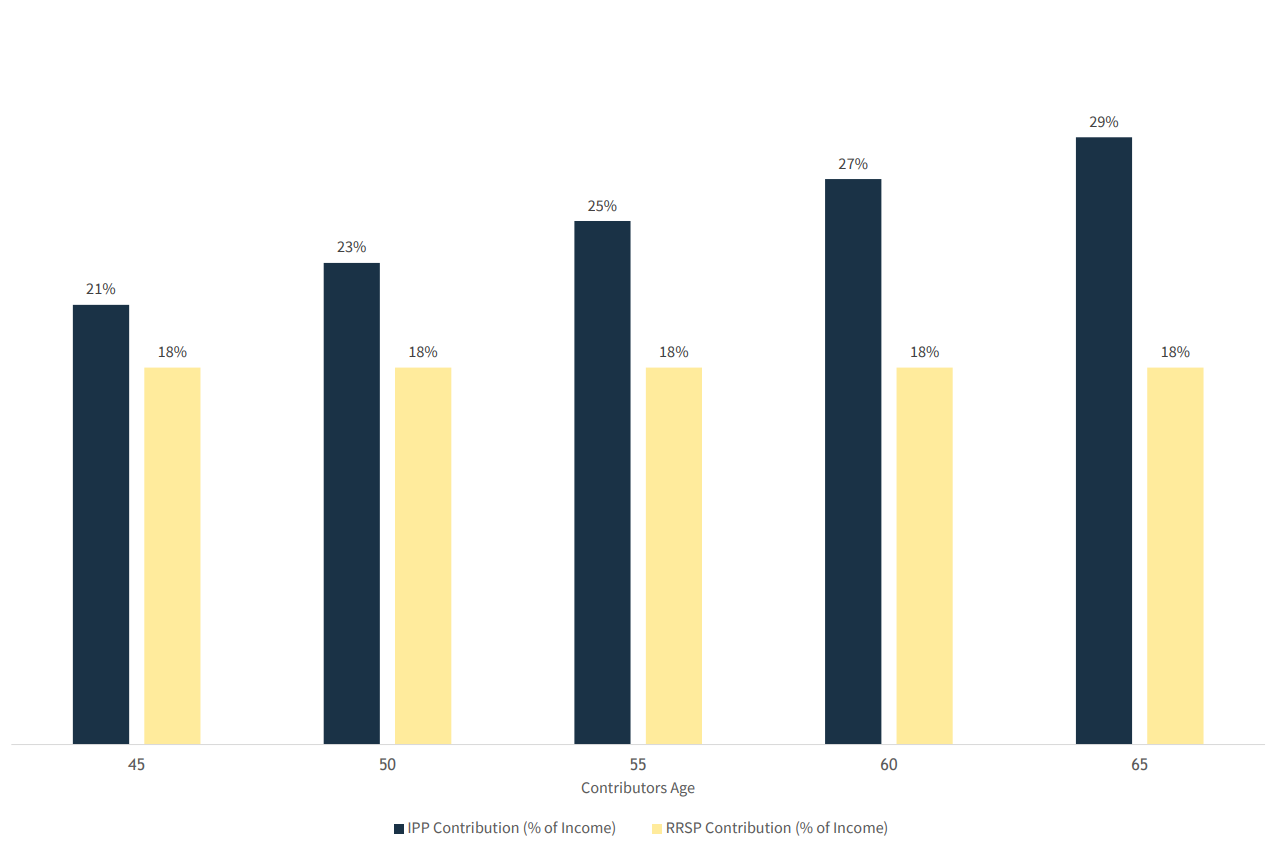

IPP vs. RRSP Contribution Limits